No Fee Unless You Win

No Fee Unless You Win

Understanding Arizona car accident laws is essential for anyone navigating the aftermath of a collision. Whether you’ve been injured or dealing with vehicle damage, knowing your rights can make all the difference in pursuing car accident compensation in Arizona.

From insurance requirements to understanding liability and filing claims, being informed ensures you’re prepared to protect yourself and secure fair compensation. This guide breaks down key aspects of Arizona’s car insurance and accident laws, helping you make the best decisions for your recovery and financial wellbeing.

Arizona car insurance laws require drivers to carry minimum liability coverage, but additional options like uninsured motorist, collision, and comprehensive coverage are highly recommended to ensure full protection. Understanding your policy and purchasing sufficient coverage can safeguard you financially after an accident.

Protecting your rights and easing your stress after a car accident does not have to be difficult. Whether you call an elite personal injury firm, like Gage Mathers, or want to handle things by yourself, there are a few important things you should know.

Everyone who owns a car needs car insurance that will cover them for property damage, medical bills, and potential liability. Car insurance is required by state law.

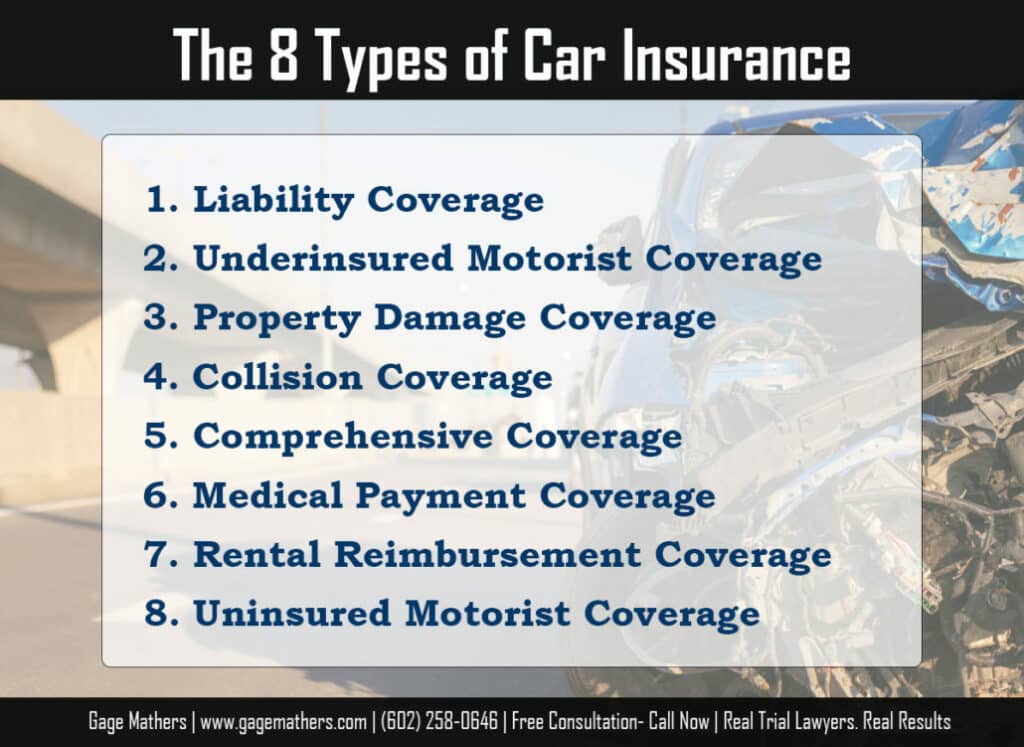

The National Association of Insurance Commissioners provides its recommendations for buying automobile insurance. One key component of purchasing Arizona car insurance is understanding the different types of insurance coverage.

In Arizona, insurance options include:

Based on the sad stories we’ve seen over the years, our car accident lawyers highly recommend people purchase all eight types of coverage. This is the only way to ensure you have good protection if you are in a crash. If you can afford it, buy insurance with high limits. This is especially true with uninsured and underinsured motorist coverage, which protects you when the at-fault driver is underinsured.

If cost is an issue, you can lower your insurance premium with a higher deductible. The deductible is the amount you agree to pay out-of-pocket before your insurance company pays anything.

Did you take out a loan to buy your car? Due to inflation and increasing interest rates, you could end up making car payments on a totaled car! Gap coverage will protect you from owing money after a crash with an underinsured driver.

Arizona law requires drivers to have automobile insurance. The minimum requirements are:

Arizona does not mandate uninsured or underinsured motorist coverage, but it is highly recommended. Uninsured motorist coverage and underinsured motorist coverage pay your medical bills and compensates you for your personal injuries if you are involved in a crash with a motorist who does not carry any automobile liability insurance (uninsured), or has insufficient coverage to fully compensate you (underinsured).

Most people are insured by State Farm, Allstate, Progressive, Geico, USAA, Liberty Mutual, and Farmers. However, some drivers are uninsured or are insured by small, non-traditional companies that provide minimal coverage. This is one reason we recommend ensuring “full coverage” includes protections for when the other driver is uninsured or underinsured.

Your insurance coverage is a legally binding contract with your insurance company. This contract includes a “cooperation clause” that requires you to notify your insurance company of a car accident and cooperate with their investigation. Failure to timely notify your insurance company may allow the insurance company to deny coverage.

This is especially important when someone else causes the crash. If you have an insurance policy that covers damage to your vehicle, your insurance company is legally bound to help you get your car fixed. If your insurance company covers the repair costs, minus your deductible, then it will go after the other driver’s insurance company to reimburse it for the repairs. This includes paying back your deductible!

Notifying your insurance company of the crash is also important if there is any question about who caused the crash or how your injuries resulted from the crash. Your insurance company needs an opportunity to investigate the crash, including analyzing your vehicle and obtaining any available electronic data, before it can pursue the other driver’s insurer or provide you benefits. When someone else causes the crash, the insurance company’s investigation can be the difference between you being fairly compensated for your injuries and you getting nothing.

Documenting the crash soon after is helpful to ensure your memory is fresh and your recollections are accurate. There are free apps available for iPhone and Android devices that can simplify the insurance reporting process. These apps guide you through the process of gathering information and starting a claim. Alternatively, an elite personal injury firm like Gage Mathers can assist you in gathering information, opening a claim with all relevant insurance companies, and controlling what is provided to the insurance companies.

Your insurance policy requires you to report any accident. No matter how big or small. No matter who is at fault. No matter if anyone was injured at the time of the crash.

Immediately after a crash, most people’s heart races, their mind races, and they cannot focus. Maybe they are worried about other people involved in the crash or notifying someone that they will be late. They may not feel pain while at the crash site. They might not notice damage to their vehicle, especially underneath. Reporting the claim to your insurer protects you later if you end up having an injury or your car develops problems. Worse, you cannot control whether the other driver or any passengers later claim they were injured, which they can do up to 2 years after the crash. If your insurance company first hears about the crash in a lawsuit filed two years later, then it may decline to defend you, decline to provide coverage, decline to renew your policy, or even cancel your policy. Thus, it is in your best interest to be the first one to notify your insurance company.

Understanding common car accident legal terms helps victims avoid insurance traps, make informed decisions with their lawyers, and ensure their right to fair compensation. Just many life-changing ...

Posted by Joseph D'Aguanno

When it comes to case results after a car accident, local law firms can provide better outcomes than national firms by devoting more attention to smaller cases and by leveraging familiarity with ...

read morePosted by Joseph D'Aguanno

There are several factors to consider when choosing a law firm: the severity of the incident, the local attorney's knowledge, and the costs. Local Phoenix car accident attorneys, such as Gage Mat...

read moreIf you or a loved one has been seriously injured, please fill out the form below for your free consultation or call us at (602) 258-0646

2525 E Arizona Biltmore Cir #A114, Phoenix, AZ 85016

get directions